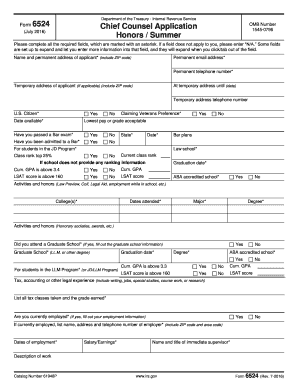

IRS 6524 2020-2025 free printable template

Get, Create, Make and Sign office of general counsel address form

How to edit pdf sheet online

IRS 6524 Form Versions

How to fill out trademark states form

How to fill out IRS 6524

Who needs IRS 6524?

Video instructions and help with filling out and completing trademark united states

Instructions and Help about trademark united

Well welcome back everybody to SocialSecurity taxation part two in this video were gonna cover how to calculate theta on your Social Security and determine how much of your SocialSecurity income may or may not be subject to tax if you missed part one make sure to go back and check it out in part one we covered a lot of the basic rules that are really important to understand in this part 2 were going to be applying those rules and show you step by step how this stuff miscalculated everything you're seeing on screen here today is free to download it's in the Excel document I'll leave a Dropbox link in the description section of the video and in the comment section of the video with that being said lets go ahead and dive into these guys but like I said make sure I want you really to understand the rules before you can understand this so make sure to go backhand watch part 1 if you have not already seen that just look in the description section of this video for the link alright guys to help you wrap your head around these were going to take it piece by piece the first thing you need to know about when it comes to your social security income the main thing thatsgonna determine whether you have to pay any tax on it at all is what other forms of income you have its based on your combined total income small of your Social Security income plus all of your other combined income it's very important to know the distinction there so other four forms of income you guys already know about these wages taxable interest even taxes imp interest counts dividends alimony business income taxable IRA distributions count taxable pensions and so on and so forth, so I've put together two examples for you guy sand were just going to cover I probably tend to cover one full example for sake of time because I don't have this stuff is really technical and I don't want you guys falling asleep on the other side of your phone or computer there I contract that to happen no injuries here were going to avoid you falling asleep and hurting yourself, so I'm just gonna kind of cover one example, but you're going to be able to download this and look at this stuff in details going to try to make it crystal clear for you guys but remember my advice to you if you really want to learn this stuff if you really want to really wrap your head around it then definitely take sometime to pause the video as we go along to read everything you're seeing onscreen and down this download the spreadsheet I think listening to this video is going to help, help you better understand it, but I think even softer you've listened to the video doing some self-study rewatching this videos going to help you make more and more sense of it, so that's what I recommend alright lets dive right into it by looking at example number one and let's say that you're a person lets say you have twenty-seven thousand dollars in wages and 1990 dollars in interest okay, and then you have no other forms of income that's it so...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find atf fingerprint card instructions?

How do I make edits in 6524 pdf without leaving Chrome?

How do I edit atf fd 258 fingerprint cards on an Android device?

What is IRS 6524?

Who is required to file IRS 6524?

How to fill out IRS 6524?

What is the purpose of IRS 6524?

What information must be reported on IRS 6524?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.